Proverbs 13:22, "A good man leaves an inheritance to his children's children..." Many Christians have interpreted this verse as a rationale for leaving large percentages of their estates to children. I believe this is a bad interpretation for the following reasons:

1. The best financial gift to give your children today is education. We are in an information based economy. In biblical times, the inheritance of land was crucial to avoid becoming an indentured servant. But rules that applied to an agricultural society don't apply to our current society. Very few people live on farms these days.

2. Children who inherit large sums of money are less likely to be productive citizens. A book written ten years ago- The Millionaire Next Door- chronicled this in detail. The authors of that book- Stanley & Danko- labeled leaving your children large sums of money economic outpatient care. Stanley & Danko found that the more dollars adult children received, the fewer they accumulated. While those who were given fewer dollars, accumulated more.

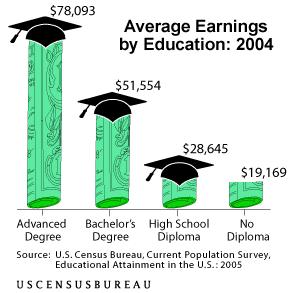

The chart above was the conclusion of a recent US Census Bureau study. As you can see, the financial value of education is hard to debate. If a person works 45 years, the differential in pay between a high school graduate and a college graduate is over $1,000,000 during that time span.

My belief is that leaving a monetary inheritance to your children is a good idea only if they have been properly trained to be good stewards of those resources. One of my fundamental beliefs is that we should strive to get the maximum amount resources into the hands of the best stewards. My definition of a steward is someone who manages the resources of another striving to maximize return on those resources. Implicit in this definition is that God is the owner of all resources and we are by nature managers.

The problem is that we almost never see it that way. Money has a way of attaching itself to us like a leech. It tries to reassure us that we deserve it and the more the better. Money causes us to be paranoid as we try to hold on to the illusion that it will somehow come through for us. Money brings baggage. Bruce Springsteen said it well. When he was asked what the difference between making $50 per concert when he was first starting out and $500,000 per concert later on. He said, "When I made $50, I had $50 problems. Now that I make $500,000, I have $500,000 problems."

How much should you leave to your kids? There are no easy answers to that question. Here are some ideas to ponder:

- Create incentives. Some parents offer to match their children dollar-for-dollar in paying off debt. Other parents match savings or giving. There are some unique ways to encourage the right behavior patterns if you meditate on the end goal.

- Encourage memories. Family vacations are a terrific gift. Why not enjoy the inheritance with them and plan some special events for those you love?

- Give inheritance money to a charitable trust or donor advised fund. This could be a great tool for training children to be generous and wise managers of dollars to be used for the benefit of others. It would be a low cost family foundation.

- Pay for education- not only for your children but also for grandkids. As the chart above shows, it is hard to beat education as an investment in your family's future.

Because I have witnessed so many ruined by inherited wealth, I believe people should be very thoughtful in how they distribute their estates. I believe there is a strong argument to be made for not permanently repealing the estate tax and just having some high exclusion amount- such as $5 million per family. This would protect most family farms and family businesses.

Yes- the estate tax is double taxation. I realize that. Yes- I think the government will be poor managers of your estate. I am in favor of less government any day. But, you can choose to distribute an estate that is over $5 million- which applies to less than 1% of the population- to charity instead of government. If you are in the 99% that has less than $5 million- as most of us are- you should still consider the most effective use of the assets that have been entrusted to you.

The goal of the Christian should always be more generosity to others and frugality towards self. It is easy to theorize about but tougher to practice. But intelligent generosity is needed. Throwing money to poor stewards- whether it is your kids or a charity- is as wasteful as mindless consumption. Excellent stewards who understand the stewardship mandate- Genesis 1:28- deserve the opportunity to do good with greater amounts as they look to grow, expand and cultivate the beauty of God's creation for His glory.

In His Mercy,

Ashley Hodge

4 comments:

What a wonderul blog you have! I just found you through (Debt)ective. I am glad I did! I have my own blog and we struggle with money daily! I understand the Goodwill clutter thing(I think I caught the bug a few monthes ago)

Keep up the Good Work!!

Blessings,

Thanks for the feedback and encouraging words.

God Bless,

Ashley

I just found out you wrote a book how exciting! Is everything you wrote in the book on your blog? I have not found anything on your blog dealing with your struggles with money...Do you have any? How did Crown Finicial help you? Sorry for all the questions:)

Blessings,

Debt r us,

Some of the themes on the blog are included in the book, but the book is different in many ways. I do talk more about personal struggles with money in the book.

Crown has helped me in so many ways- it is hard to limit them. I would say the big thing is with contentment. And we significantly downscaled lifestyle after taking Crown. God Bless, Ashley

Post a Comment